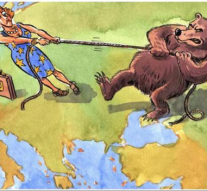

Deteriorating EU–Russia economic relations

Economy 6 February 2021On December 10th last year, the leaders of the European Union (EU) gave the green light for the six-month prolongation of economic sanctions that were imposed against Russia because of its role in the conflict in Ukraine. This seems not to be the only reason for the deterioration of bilateral relations. Arrest of the oppositional leader Alexei Navalny at the end of January this year was another bone in European relations with Russian Federation. Will the intensification of political tension influence the economic cooperation? Have the economic relations between the two sides deteriorated deeply?

French President Emmanuel Macron and German Chancellor Angela Merkel informed other EU heads of state and government about the state of negotiations in the so-called Normandy format during the EU summit in Brussels, last year. They recommended the prolongation of the sanction because it had made little progress. The so-called Normandy format is a diplomatic process involving Ukraine, Russia, Germany and France, aimed at resolving conflicts in parts of eastern Ukraine between separatist formations that support Russia and the Kiev government. There has been no formal summit of the Normandy format since December 2019, while before that it was held in October 2016.

The sanctions were first adopted in July 2014 after Russia forcibly annexed the Ukrainian peninsula of Crimea and began providing military support to separatists who were against Kiev in a conflict that killed more than 13,200 people. Since then, sanctions have been in place for all six months. The EU ambassadors will officially order weeks to produce measures that are mainly aimed at the Russian financial, energy and defense sectors.

In a declaration made by the EU High Representative for the Security and Defence policy, issued on January 18th, was stated that this detention “confirms a continuous negative pattern of shrinking space for the opposition, civil society and independent voices in the Russian Federation. The EU will follow closely the developments in this field and will continue to take this into account when shaping its policy towards Russia. The European Union has condemned in the strongest possible terms the assassination attempt, through poisoning using a military chemical nerve agent of the “Novichok” group, on Alexei Navalny, to which it responded by imposing restrictive measures on six individuals and one entity”. Furthermore, the EU announced that it will continue to call upon the Russian authorities to urgently investigate the assassination attempt on Mr. Navalny in full transparency and without further delay, and to fully cooperate with the Organisation for the Prohibition of Chemical Weapons (OPCW) to ensure an impartial international investigation.

The two sides signed Partnership and Cooperation Agreement (PCA) in 1997 which regulates provision on business and investment, coordination of social security, establishment of the companies on the both sides, cross-border supply of services, and so on.

Since then, both sides cooperated increasingly good, until 2014 when the EU imposed sanctions towards Russian Federation due to the conflict in Ukraine. Over the last three years, the EU imported more goods than it exported from Russia, and thus, registered negative balance. But when it comes to services, situation is quite different. EU exports far more than it imports from Russian federation, but still these figures of maximum 25 billion Euros are small. A second factor is the policy of import substitution progressively deployed by Russia since 2012, largely coinciding with Russia’s accession to the WTO. The accession to the WTO had raised the expectation that trade with Russia would benefit from sustained liberalisation. Instead, Russia has progressively put in place numerous measures favouring domestic products and services over foreign ones, and incentivising localisation of production in Russia by foreign companies. Related measures often contravene the spirit and/or the letter of WTO rules and are the origin of many trade irritants. Since Russia joined the WTO in 2012, the EU has filed four disputes in the WTO against Russia.

The Russian permanent mission to the EU states that in 2017 according to the Russian customs statistics the EU-Russia turnover was 246,5 billion USD which is 22.9% than in 2016. The Russian exports to the EU in 2017 amounted to 159.6 USD (+22.1%) and the Russian imports – to 86.9 USD (+24.4%). Thus the Russian trade surplus was 72.7 billion USD. That means that the decrease in the bilateral trade observed in 2013-2016 has come to an end, and since 2017 the Russia-EU turnover started to recover rapidly. In the first half of 2018 that trend has consolidated. In January-June 2018 the turnover reached 144.0 billion USD which is 21.5 per cent more compared with the same period in 2017. The structure of trade in goods remains almost unchanged. In 2017–2018 raw materials (first of all mineral fuels) accounted for the major share of Russian exports to the EU, with Russia’s imports consisting mainly of machinery and transport equipment, chemicals and related products, and various manufactured goods.

The political issues will always present a burden towards the relations among the two sides. However, the EU needs to more careful once it establishes measures which might impede economic rise of its own Member States.