Going for Growth: a tale of two OECDs

Economy 9 March 2015A few days ago the OECD published its annual Going for Growth report, an analysis of the economic situation in Europe and beyond Europe, with reform and policy proposals. The title of this year’s issue is “Breaking the vicious circle”. To understand the origin of such viciousness we need to explore the split personality of the OECD. Breaking the circle will then perhaps require the reconciliation of some of its contradictory policy suggestions.

A split personality?

The Organization for European Economic Cooperation was probably the first truly “European” institution to be established. It was created in 1947 in Paris to manage the US aid program to Europe after the II World War, better known as the Marshall Plan. Since then it has expanded its scope to cover most developed and some developing countries. Its historical role and exceptional analytical capacity has lent it enormous credibility and influence over the years. The OECD matters more than people often realize in shaping the economic policy debate in Europe and the world.

As noted previously, over the past decades the OECD has been spearheading an essentially supply-side policy agenda. It did so by developing several “reform” indicators such as the Product Market Regulation and the Employment Protection Legislation. These indexes measure countries’ degree of liberalization, in terms of barriers to trade, competition and labour protection.

More recently, after the financial crisis, the OECD has been a fervent supporter of fiscal consolidation efforts and tight monetary policies. Already in 2010, the OECD was suggesting the US Federal Reserve to increase interest rates for fear of inflationary pressure stemming from an excessively relaxed money supply. And no later than in 2013, the then Chief Economist of the OECD, Pier Carlo Padoan (current Italy’s Finance Minister), interviewed by the Wall Street Journal declared that “fiscal consolidation is producing results, the pain is producing results“.

In this year’s Going for Growth Report, however some substantial deviations begin to appear in the OECD’s position. The editorial written by the new Chief Economist Catherine Mann is revealing in this sense. “Structural reforms” are becoming difficult to implement, says Mrs. Mann, because Governments find themselves trapped in a “context of chronic demand shortfalls“. At the same time such reforms are increasingly considered “counter-productive” because they “exacerbate income inequalities“. In particular labour market reforms aimed at “restoring competitiveness” have been introduced without sufficient “fiscal resources to cushion the social impacts“, resulting in “severe job and income losses, hurting young people the most“. This is creating the vicious circle: a downward spiral where a demand shortfall is further depressed by pro-cyclical structural reforms.

In other words, the OECD has started to recognize that the supply-side policies it has so far strongly advocated have had serious negative repercussions on the population. The problem is that fiscal policies have not been supportive enough and Mrs. Mann explicitly calls for greater “investment in public infrastructure“.

So in the space of less than one year, the OECD went from saying that “fiscal consolidation” and “pain” were “producing results” to asking for more public spending to correct the damaging effects of the very same “structural reforms” it has been advocating for years.

Recognizing the symptoms

This year’s Going for Growth Report does not represent a radical U-turn in the economic policy priorities of the OECD, from supply- to demand-side, but rather a gradual reconciliation with reality.

The OECD did not abandon its main themes, like labour market reforms or liberalization; it simply diluted every message with warning about drawbacks such as raising inequalities, youth unemployment, reduction of households’ disposable incomes, genders’ gaps, environmental sustainability, etc.

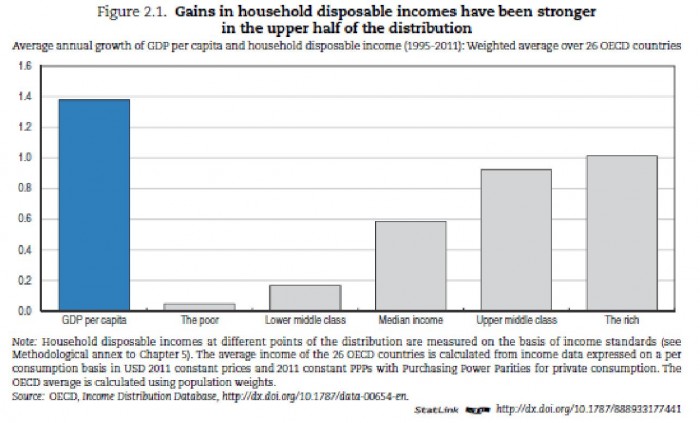

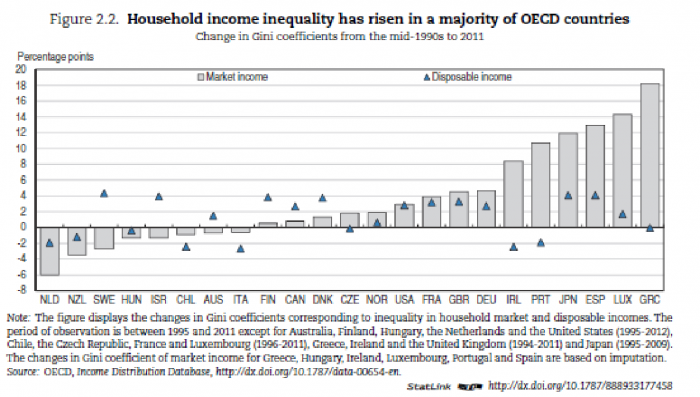

For example, the second chapter of the report is completely dedicated to income inequality while the third to environmental sustainability: a non-negligible difference compared to last year’s edition, entirely focused on structural reforms. The following graphs probably best summarize the situation. Most of the gains in GDP per capita of the past 15 years have accrued to the highest ranks of society and inequalities have risen considerably in those countries that have been victims of the most severe consequences of the crisis.

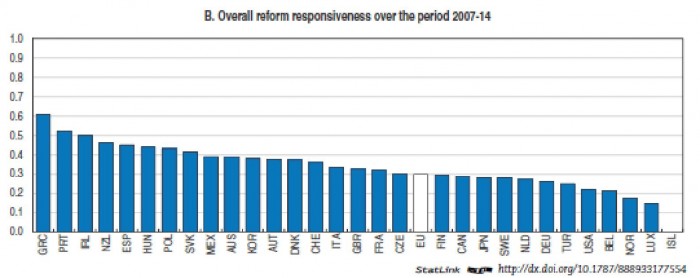

But probably the clearest symptom of a fundamental mismatch between predictions and reality is represented by the following graph. The height of the blue bars indicates the degree of responsiveness of countries to the reform priorities of the OECD: the higher the bars the more countries have been reforming in the period 2007-2014. The country that comes first is Greece, followed by Portugal. Then for the EU there is Ireland and Spain. In other words, the so-called “PIGS”.

This graph has been also the object of a minor mystery, since it appears to have been changed after some economic commentators spotted it and its tone became slightly less triumphalist.

The best reforming countries are all stuck in deep depressions, with staggering levels of unemployment. And, to make matters worse, as Eurostat reported recently they have also all fallen into deflation. Deflation is a particularly pernicious issue. Besides the debt-deflation consequences that are widely known since the Great Depression, there are all sorts of other problems associated with deflation. Deflation scrambles the economic radars, so to speak, and creates illusory growth. For example for 2014 the Spanish statistical office estimates that real GDP growth has been +1.4%; however this is the result of only a 0.9% nominal GDP growth combined with negative inflation of -0.5%. Even more worryingly, as Greece’s Finance Minister pointed out, the celebrated GDP growth of the country in 2014 was actually the result of a fall in prices that exceeded a fall in nominal GDP!

Know thyself

In conclusion, this year’s OECD Report is instructive in many ways. First it shows that “ideas matter”: a change in the leading role of the organization has brought about a significant change of tone and vision. Secondly it shows that while the overall policy stance of the OECD has not radically changed, some cracks are appearing through which a whole set of other priorities are creeping in: greater emphasis on aggregate demand, income inequalities and environmental concerns above all. Thirdly it dispels some misconceptions about the responsiveness of crisis-hit Governments to reform. This in turn raises a question about the effectiveness of such reforms.

And this leads us to the final remark that despite many efforts to prove otherwise, there does not seem to be a silver bullet in economics, there is no optimal reform agenda that can be synthesized in a laboratory and then applied to our societies for the achievement of the best possible prosperity. Or to use the Greek aphorism, even the OECD should start “knowing itself” to understand its limits. Reforms should result from a democratic interaction where costs, benefits, winners, losers and societal priorities are carefully balanced.